Why Your Toronto Business Needs Liability Insurance

As a Toronto small business owner, you routinely face risks and potential lawsuits. Business liability insurance is an essential part of protecting your business.

Business liability insurance is a package of insurance coverages that can help cover legal costs and any legal settlements should you face a lawsuit as a Toronto business owner.

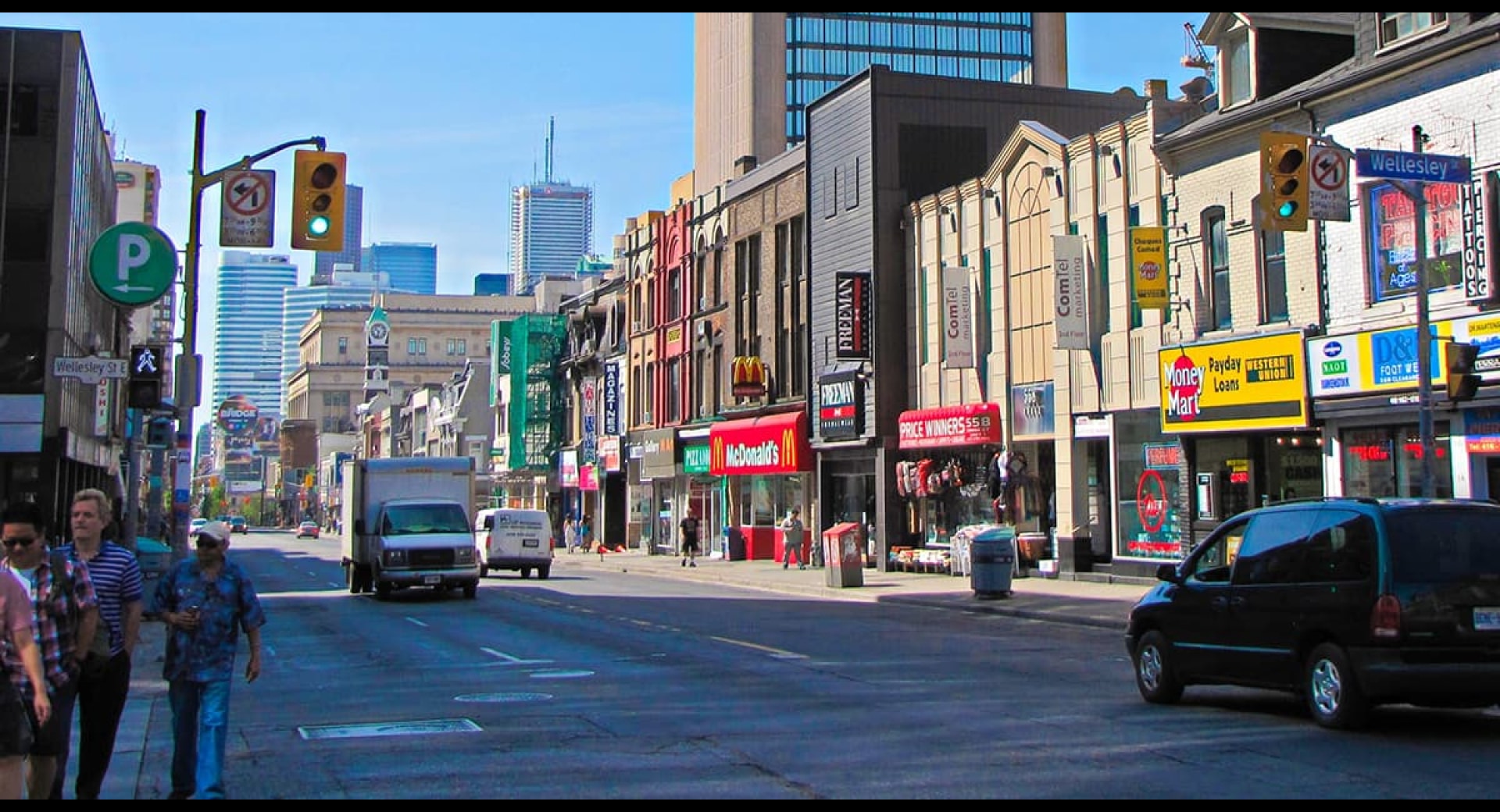

Is your small business in downtown Toronto or located in one of the city’s many neighbourhoods?

Are you located in Scarborough, Etobicoke, North York, York, and East York?

Wherever your Toronto small business is located, or if it’s in Greater Toronto Area (GTA), or anywhere in Ontario, your Western Financial Group business insurance expert will give you top-notch insurance advice at the right value for you.

What is business liability insurance for Toronto small businesses?

Business liability insurance is a package of insurances that protects your Toronto small business against lawsuits involving third-party bodily injury or third-party property damage.

It includes:

- Commercial general liability (CGL) insurance

- Product liability insurance

- Professional liability insurance

- Directors and officers liability insurance

- Cyber liability insurance

Business liability insurance isn’t required for your Toronto small business. It helps protect you, though, you from the unexpected.

If you’re asked whether you have liability insurance, you will be able to say with confidence that you have protected your Toronto business with it. For example, if you run a Toronto contracting business, you may be required to show to clients that you have it or to secure a contract.

How business liability insurance protects your Toronto business

1. A customer comes into your Toronto convenience store and slips on your wet floor. You get sued. Commercial general liability insurance helps pay for legal costs and judgement and any medical costs.

2. You were serving samples of home-made hot sauce at your Toronto restaurant and a client said it made them so ill they were hospitalized. She sues you for bodily injury due to this product. Product liability insurance helps covers court costs and medical expenses.

3. Plumbing in a new commercial building has caused extensive water damage. As the engineer overseeing the building’s plumbing, you and your engineering business are sued for negligence. Professional liability insurance (also known as errors and omissions insurance) can help cover your legal costs and any court-awarded settlement.

What determines how much professional liability will cost you for your Toronto business?

- Size of your Toronto business

- What you sell

- Years of experience

- Annual revenue

- Location

- Equipment you have

- Past claims

Here’s a business liability insurance checklist:

- Do you have the best Toronto business insurance rate that suits your work?

- Do you have the right amount for your deductible and regularly review it to make sure it’s the right amount for you?

- Are you or your employees using personal vehicles for work?

Tell me about the specifics of my Toronto business liability insurance package:

Commercial general liability (CGL) insurance

This type of insurance protects your Toronto small business from the most common risks you may face daily in your business, such as third-party property damage and bodily injury to a customer or supplier.

It does not cover you or your employees.

Without CGL insurance, you would be responsible for paying any liability costs out of your own pocket if a client were to get injured or her property damaged at your engineering office. Can you afford that?

CGL insurance is also known as “slip-and-fall” insurance.

It’s recommended that you have at least $1 million in CGL insurance and more if you have a large Toronto business.

Product liability insurance

Product liability insurance typically covers situations where a customer (a third party) purchases a product and it causes a bodily injury or property damage.

As a Toronto small business owner, you could be found responsible for the damages if the source of the issue can be traced back to your business.

Product liability insurance will help protect your business from legal costs if you’re found responsible for a product causing bodily injury or property damage to a third party.

Professional liability insurance

It’s a type of liability insurance that helps cover any claims that allege negligence or failure to deliver a service as promised, resulting in financial loss, for example, to a customer.

It’s also known as errors and omissions (E & O) insurance.

This type of insurance can help cover your legal fees and court-awarded settlements up to your policy limit.

Note: Professional liability insurance does not cover deliberate misrepresentation or criminal acts.

Directors and officers liability insurance

If your Toronto business is large enough to have a board of directors, it’s recommended that you have directors and officers liability insurance as protection from claims of negligence.

Directors and officers insurance also helps provides financial coverage for legal expenses to help defend a board member against claims.

What directors and officers insurance typically covers

- Misleading statements, reporting issues, inaccurate disclosure

- Negligent acts and allegations of misrepresentation

- Breach of legal or fiduciary duties

- Decisions that result in adverse financial consequences for shareholders

- Wrongful dismissal and employee discrimination claims

- Failure to adhere to federal and provincial laws and regulations

Cyber liability insurance

If your Toronto business stores your customers’ names, addresses and credit card information, you are vulnerable to a cyberattack.

Without cyber insurance, you will have to pay out of your pocket for the cost of restoring your system. You may also be liable for damages to third parties whose information has been stolen and you may have to pay for notification expenses to inform your clients affected by a breach.

What do I do if I need to make an insurance claim?

- Contact your broker immediately after any business-related mishap at your Toronto business. Waiting to file a claim can confuse insurers about the severity of the damages to your business.

- Know your policy so that when you contact your broker you are familiar with what will be covered or not.

- If there’s any damage, document it. Take photos right away and write down what happened.

- Do not throw away damaged goods after taking photos. Keep the physical evidence so that your adjustor can see it.

- Do not invite lawsuits. Don’t say anything that could be used against you, especially if you aren’t sure what happened.

- Be honest about what your damaged property is worth. Damaged commercial property is generally valued according to its actual cash value or replacement value.

Please share this article with your friends

Talk to an Insurance Expert

Call Us Now 888-595-3104